DaziT

Project for the modernisation and digitalisation of the Federal Customs Administration. The name is a combination of Dazi, the Rhaeto-Romanic word for customs, and T for transformation.

Source: YouTube, Federal Office for Customs and Border Security

Digitalisation does not stop at customs. That is why the customs administration will be made fit for the future by 2026.

Due to DaziT, the competitiveness of Switzerland as a business location will be strengthened and border security will be increased for the benefit of the population, the economy and the state.

Among other things, the assessment and control processes will be simpler, more consistent and fully digitalised. The new goods traffic system Passar will replace the current customs applications e-dec and NCTS.

The main focuses of the transformation project DaziT are

- Organisational refinement

- Simplification and digitalisation

- Revision of customs law

- Digitalisation (new apps, new applications)

Chances

- Uniform and integrated processes for import, export and transit New processes for new involved customs parties (importers, industry, carriers)

- Various accesses to FOCSBS systems B2B (interfaces), ePortal and mobile applications (apps)

- Digital documents

- Unified system (uniform master data and data structures, data exchange via XML, communication via web services, email)

Challenges

- Complex project planning (FOCBS, IT service providers, involved parties in customs matters (forwarders, importers, exporters ...)

- Short transition phase at the start of the new application

- Fix deadline for launch

- New types of involved parties in customs matters become part of the processes

- New customs processes require new integration processes (internal IT systems)

- Investments in software development (IT service provider) and in software implementation/integration (involved parties in customs matters)

- Training, know-how

- New hardware and software required for customs operators (e.g. smartphone/tablet for drivers)

Organisational refinement

The organisational refinement includes

- New job profile

- New organisation

- Cultural transformation

- Uniform appearance

Revision of the customs law

The digitalisation and standardisation of the new processes and systems require the adjustment of the current legal basis. The current Customs Act will be simplified and adjusted to the new processes. This includes three main changes:

- new framework law: simplification and standardisation of all processes in duty levying and the control of the cross-border movement of goods and persons by the FOCSB.

- Reduction of the current customs law to a pure remission of duties: regulation of customs duties, customs duty assessment and penalties for violations.

- Adaptation of tax and non-tax decrees

Goals of the law revision

- Simplification and harmonisation of customs and duty procedures

- Standardized services for non-tariff decrees

- Uniform basis for risk analysis, control and prosecution

- end-to-end digitalisation

- Adjustment to digitalisation of data processing

- Task-oriented organisation

Impact of the new customs process on economy

| Topics | Impact |

|---|---|

| Duties and tariffs |

|

| Declerations/ Provisions for goods |

|

| Simplification and exemptions |

|

| Activation |

|

| Customs warehouse |

|

| Simplification of assessment process |

|

| Appeals |

|

Passar

Passar is the new goods traffic system (WVS) of the BAZG and will replace the current e-dec and NCTS systems. It contains the entire customs clearance process from declaration to assessment, including control of the goods process at the border. This applies to all types of transport (road, air, rail, waterways, etc.) and goods regulations.

Passar will go live on 1 June 2023 with the standard processes export and transit via the B2B, ePortal and upload channels. A delay of the deadline is not possible due to obligations of the BAZG towards TAXUD (= Taxation and Customs Union Directorate-General). There will be parallel operation until 30 November 2023. The current goods traffic systems NCTS and e-dec Export can definitely no longer be used from 1 December 2023 (NCTS) and 1 July 2024 (e-dec Export).

The replacement of e-dec Import will occur only on 1 January 2025.

The transition of the current NCTS and e-dec systems to the new uniform goods traffic system will be carried out in three phases:

Phase 1

- Passar 1.0: transit and export

- NCTS and e-dec export temporarily as parallel operation

Phase 2

- Passar 2.0: transit, export and import

- e-dec import temporarily as parallel operation

Phase 3

- Passar 3.0: all provisions for goods and functions are available on Passar

Milestones

The resulting milestones are as follows (as at 22.9.2022):

- 01.06.2023: introduction of Passar 1.0; start of parallel operation Passar/NCTS and e-dec Export

- 01.10.2023: Authorised consignee system ready

- 31.10.2023: last goods declaration possible for NCTS transit and export

- 01.12.2023: end of parallel operation Passar/NCTS; deactivation NCTS; transit only with Passar

- 30.06.2024: end of parallel operation Passar/e-dec Export; deactivation e-dec Export; export only with Passar

- 01.01.2025: introduction of Passar 2.0; start of parallel operation Passar/e-dec import

- 01.07.2025: end of parallel operation Passar/e-dec import; import only with Passar

Access to Passar

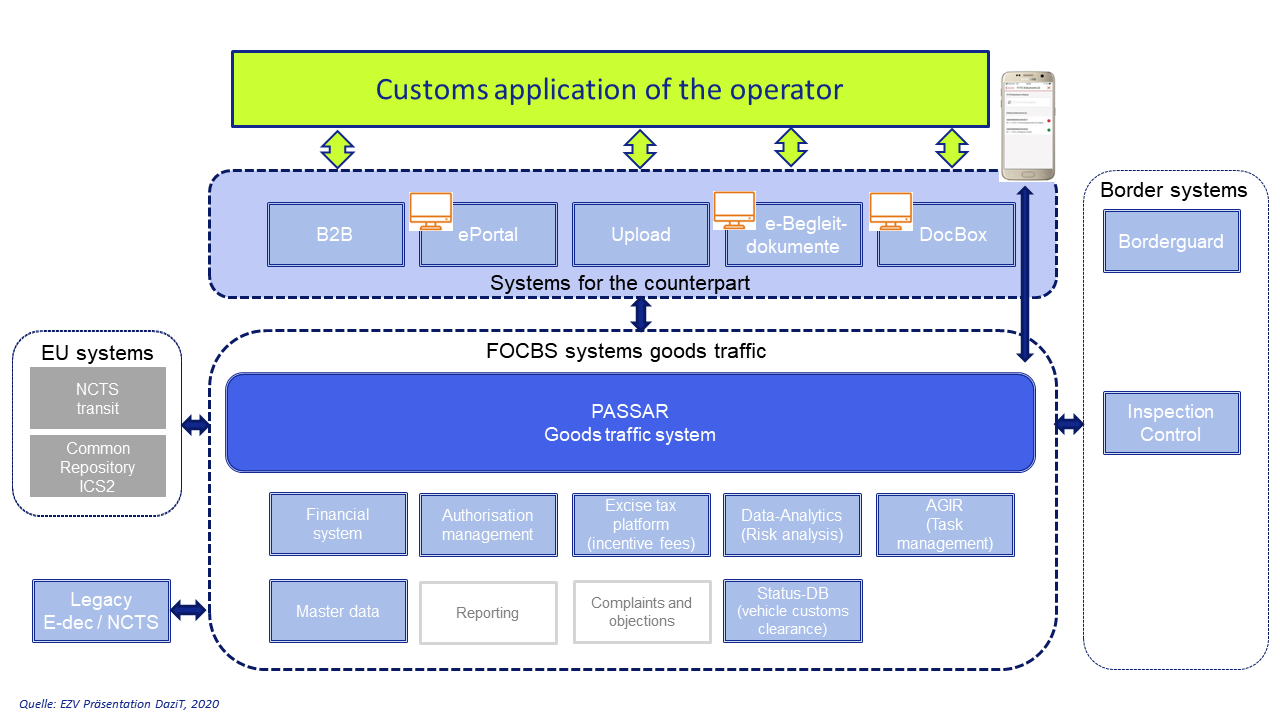

The Passar goods traffic system is linked to the EU systems on the one hand and, in the transition phase, to the current e-dec/NCTS systems and to other border systems. The connection of Passar to in-house customs applications can be made through numerous channels.

The e-portal is the platform through which all information and services of the BAZG can be accessed. In addition, customs authorisations can also be applied for via the e-portal. With the upload function, data can be transferred to the e-portal and processed further there. The platform has been online since 2 November 2020, and initially comprises the two applications Biera and Chartera (formerly known as DocBox).

The B2B Gateway is an electronic interface that allows own customs and ERP systems such as Declare-it to be connected to Passar.

e-Begleitdokumente is a stand-alone platform that can be used to transmit accompanying documents and other records to the customs office. Via a direct interface, the data can be uploaded in PDF and Excel using the FOCBS website (WebUI) or web service.

Chartera is the new output management system of the FOCBS. In future, all relevant customs documents (e.g. eVV, Bordereau) can be obtained via Chartera too. In addition, mails and letters will be sent to the counterpart via Chartera. The documents made available via Chargera are archived in compliance with the law (10 years). Registration for the Chartera takes place via the ePortal.

Passar process

- The data controller responsible for the shipment (e.g. importer, consignor or logistics service provider) registers the goods in the goods traffic system using ePortal or his own customs clearance application.

- In parallel, the means of transport must be referenced. This is the responsibility of the carrier (logistics service provider, freight forwarder), who transmits the corresponding data to customs by means of ePortal, smartphone app or his own customs clearance application.

- Upon arrival at the border customs office, the border entry of the vehicle is recognised and the declaration referenced to the vehicle is automatically activated. As of this time the goods declaration is legally binding and can no longer be changed.

- Activation messages of the border crossing as well as messages from foreign customs systems (Borderguard) are processed in Passar.

- As in today's e-dec, the selection takes place with possible intervention. An intervention can be carried out directly at the border or at a location determined by the BAZG and concerns persons, goods and/or means of transport.

- The driver or the party responsible for transport receives an activation control message on his portable device (smartphone, tablet, etc.) as well as the selection results of the goods. By means of traffic light control based on the selection result, the carrier knows whether he is being checked or can continue driving directly.

Downloads and links

![]()