DSM Nutritional Products Ltd. automates

customs clearance and eVV Import with SISA

DSM Nutritional Products Ltd. uses the software solution Declare-it Export as well as Dutax from SISA Studio Informatica SA for efficient customs clearance. It has thus saved costs in the 6-figure range and significantly increased process effciency in its daily business. This is a good example of how eVV Import can be introduced in a beneficial way.

Initial situation

DSM Nutritional Products Ltd. is a science-based company that manufactures health and nutritional products for humans and animals. The DSM plant in Sisseln (Argovia/Switzerland) mainly produces high-volume vitamin preparations. Almost all raw materials come from abroad (such as from China and the EU). Over 95 % of production is exported. Most of the goods go directly to DSM's central distribution warehouse in Venlo (NL).The complex products require a high level customs clearance know-how of the DSM employees.

DSM has been successfully using the Declare-it Export software solution from SISA since 2009. The Declare-it Export SAP® module enables seamless integration with the ERP system of SAP®. This allowed DSM to optimise the entire e-dec export process in a targeted manner.

Standard declarations allow recurring traffics and export customs declarations to be largely automated in compliance with all customs regulations. Updates of customs and internal master data management are guaranteed. The special plausibility check ensures the correct declaration. The very convenient search for all information increases the efficiency of queries.

Due to DSM customs specialists' very good experience with Declare-it (short implementation phase, high efficiency, adherence to project and budget targets) as well as the high level of satisfaction with SISA's IT and customs expertise, SISA was the first choice when looking for an automation solution for import customs processing and especially eVV Import.

Objectives

DSM had the following objectives for the eVV Import project:

- to automate import customs processing as fas as possible

- to increase cost efficiency

- to increase transparency

For this purpose, Declare-it Export should be supplemented by an import module. Among other things, this had to enable a better online control of the eVV and customs borders. Furthermore, DSM wanted to simplify considerably the VAT levy and its reimbursement.

Solution

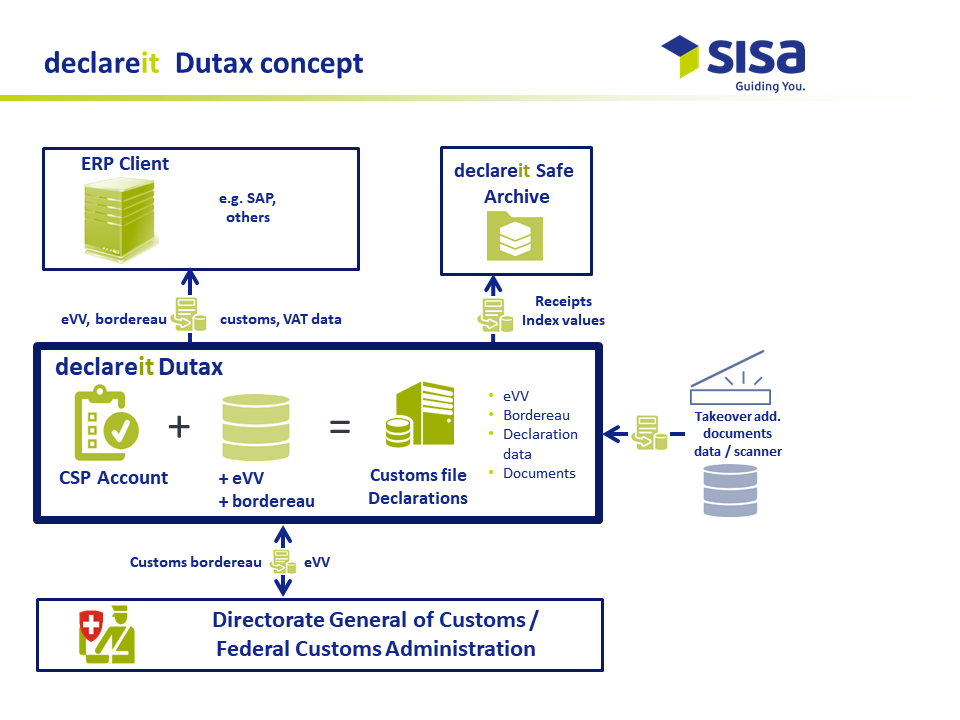

After examining various options, DSM decided on Declare-it Dutax. This cloud solution ensures the integrated processing of all customs and VAT-specific data and documents for import processing. Dutax enables DSM

- the collection of the assessment decision by the holder of the customs account immediately after its release by the customs authorities

- the online control of the eVV and customs bordereaus

- the referencing of the eVV with purchase order (PO)

- the detection of incorrect debits on the customs account

- the full search accross all documents and data.

Additionally, all eVV data is electronically archived for ten years in compliance with the law. DSM has been working with Declare-it Dutax since November 2015.

The project was completed on time and within budget. DSM's expectations of SISA were fully met. "The introduction of Dutax has also helped us to compare the services of our customs clearance partners and thus further reduce costs," explains Michael Rasch, International Trade Affairs, DSM. "The analyses have supported us in the process of concentrating on just a few partners.“

More than 90 % of export and about 80 % of import deliveries by road are now handled by one forwarder each.The DSM IT systems could be leanly linked to Dutax via interfaces.

„The introduction of Dutax has helped us to compare the services of our customs clearance partners and reduce costs.“

Michael Rasch, International Trade Affairs DSM

Customer benefit

„“With Declare-it Dutax, we were able to easily implement the tax authorities’ relocation procedure,” adds Rasch. As a result, the guarantee sum could be saved by 95%. Overall, the process automation with the help of Declare-it Dutax results in savings of a five to six-figure Swiss franc range.

The availability of all customs receipt information in digital form allows ongoing electronic verification of all movements on the DSM customs account. Moreover, all data can be quickly evaluated, e.g. according to customs tariff, forwarder origin/supplier destinations, VAT and customs duties. DSM’s raw materials and export goods are complex products that require a high level of expertise of customs offices and DSM employees. As a result, mistakes are bound to happen. Thanks to the new, high level of data transparency, these can now be rectified quickly.

Andreas Schluchter from Customs & Transportation at DSM says: „Thanks to the transparency provided by the system, I have better control with Dutax and see more quickly where something has been wrongly cleared through customs. The possibility of accessing all data and documents in real-time is crucial for us to ensure smooth communication and fast problem solving with the customs authorities.“

”. The eVV also increases efficiency by reducing the administrative work. The combination of Dutax and Declare-it Export enables a holistic IT integration of the customs process. All in all, a successful project with high verifiable benefits.

In conclusion, Abdullah Hizal, Head of Supply & Demand Chain, plant Sisseln plant at DSM, says: “SISA is a typical SME, agile, flexible and with short communication channels. Project management and support are competent. We have a direct contact person and get quick answers to our questions. Moreover, the integration into SAP® makes correct processing much easier“.

„Thanks to the transparency provided by the system, I have better control with Dutax and see more quickly where something has been wrongly cleared through customs. The possibility of accessing all data and documents in real-time is crucial for us to ensure smooth communication and fast problem solving with the customs authorities.“

Andreas Schluchter, Customs & Transportation DSM

Outlook

DSM will continue to automate its foreign trade processes. In future, brochures, technical equipment and sample consignments will also be processed with Declare-it for customs purposes. In a further step, the company wants to automate tariff classification and HS product classification.

The management of supplier declarations and preference calculations within free trade agreements are also to be integrated into the existing IT infrastructure. Here too, SISA can score as a supplier of choice with its extensive product portfolio.

Project - Quick Wins

- Significant cost savings

- Increased transparency

- Customs compliance

- Fast error detection and correction

- Extensive statistical evaluations and analyses

- Easier control of customs clearance partners

![]()