Import

When foreign goods are imported, they are given the customs status of domestic goods. Customs duties are raised by the Swiss customs authorities and federal non-customs provisions (NZE) are applied.

Fees

Customs

Customs duties are payable on importation. Only in certain exceptional cases such as diplomatic goods, removal goods or samples goods can be imported duty-free.

- Normal rate

- Preferential rate – for developing countries with Form.A or countries with which free trade agreements exist, with the corresponding proof of origin (EUR.1, EUR-MED or invoice declaration)

Customs duties are normally calculated based on gross weight. In exceptional cases, the assessment can also be based on the number of pieces, litres, or metres.

Customs duties can be refunded on returned goods (not 100% and without charge).

Import duties depend on the rates defined in the customs tariff, the country of origin and whether a preferential assessment can be applied. Depending on the constellation, this can affect the competitiveness in the Swiss market.

Value added tax

When goods are imported, VAT is due directly on importation.

- 7.7% normal rate

- 2.5% reduced rate (e.g. food, books)

If VAT charges are less than CHF 5, they will not be raised.

Additional duties

Additional taxes or duties are due on certain goods:

- Monopoly (fee for goods containing alcohol)

- VOC (incentive tax on volatile organic compounds)

- Car tax (4% of VAT value for vehicles under 3.5t)

- Beer tax

- Tobacco tax

- Mineral oil tax

- etc.

Fees

Additional fees may be due for special procedures (e.g. corrections, customs preferences).

e-dec Import

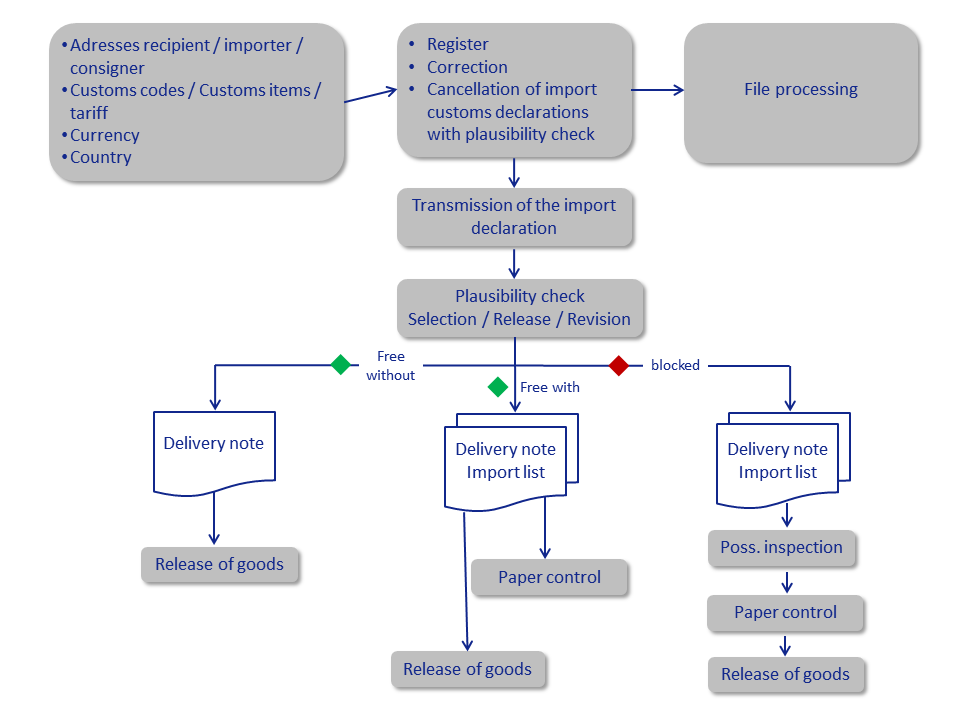

With e-dec Import, an electronic customs declaration is sent to customs. If the declaration is accepted, customs creates PDF files based on the data and sends them back to the declarant (e.g. forwarding agent). Based on the selection result and the status of the declarant (e.g. Authorised Consignee), a decision is made as to which documents are required (e.g. delivery note).

e-dec

e-dec is the platform for electronic cargo processing of Swiss customs. It allows import, transit and export goods to be declared and validated electronically.

The documents required for customs clearance, as well as the import list and delivery note, are prepared on the customs server and transmitted to the forwarding agent.

Process e-dec Import

Duty free or duty-reduced importation of goods

Free Trade Agreement

Switzerland has concluded free trade agreements with numerous countries. An updated list of existing free trade agreements can be found here.

Preferential origin

Goods originating in countries having a free trade agreement can usually be imported duty-free or at reduced duty rates. This is called a customs preference.

To ensure that these preferences to be granted, a certificate of origin (EUR.1 or Form.A) must be issued by the country of origin. The reduced preferential rate is shown in the customs tariff (www.tares.ch) for certain groups of countries and for each country individually.

Origin of goods

However, the preferential treatment under the free trade agreements applies only to goods which comply with all all the requirement concerning origin and prescribed procedures.

A valid proof of origin, which must comply with the origin provisions of the respective agreement, is mandatory for preferential imports.

Preferential treatment is not granted automatically and must, therefore, be requested in the customs declaration.

If by mistake or due to special circumstances no movement certificate was issued at the time of export, it may be issued retrospectively.

In this case, the import customs declaration must be provisionally declared without preference, and customs duties are payable at the normal rate. If the preferential documents are submitted subsequently within a period specified by the customs authorities, the customs authorities change the declaration to the more favourable preferential rate and any customs duties paid in excess are refunded.

Relief of customs duty on googs, depending on type of intended use

These are goods which may be imported at a reduced rate of duty because of their intended use. The customs beneficiary must confirm the reduced duty rate in writing.

Tariff quotas

Tariff quotas are mainly found in the area of agricultural products. This is intended to protect domestic agriculture from cheaper foreign products. If the quota is exceeded, import duty must be paid at the normal rate.

![]()