Export

The exporter must ensure that the export of goods is not subject to any prohibition or restriction such as sanctions, embargoes, or military equipment. Possible refunds for foreign returns or from non-customs provisions (VOC, CO2, monopoly fees, chocolate law) can be claimed.

According to Customs Compliance, the exporter must ensure that the export of the goods is not subject to any prohibition or restriction (sanctions, embargoes, dual use and armaments).

As soon as the goods are abroad, in a bonded warehouse or have been placed under a transit procedure, the export procedure is considered to be completed.

e-dec Export

An e-dec export declaration can be implemented in two ways. The key factor is whether the consignor of the goods qualifies as an Authorised Consignor or not.

e-dec

e-dec is the platform for electronic cargo processing of Swiss customs. It allows import, transit and export goods to be declared and validated electronically.

In the option in which the consignor is not an Authorised Consignor, the procedure is applied in a 2-step process. The shipper of the goods registers the goods in the e-dec system and receives an export list with an expiration date, usually 30 days. During this period, the shipper can hand over the goods to the carrier and have the carrier handle the second phase of the declaration. During this period, the customs system sends the declarant of the export declaration a reminder that the export declaration will be deleted in, for example, 15 days.

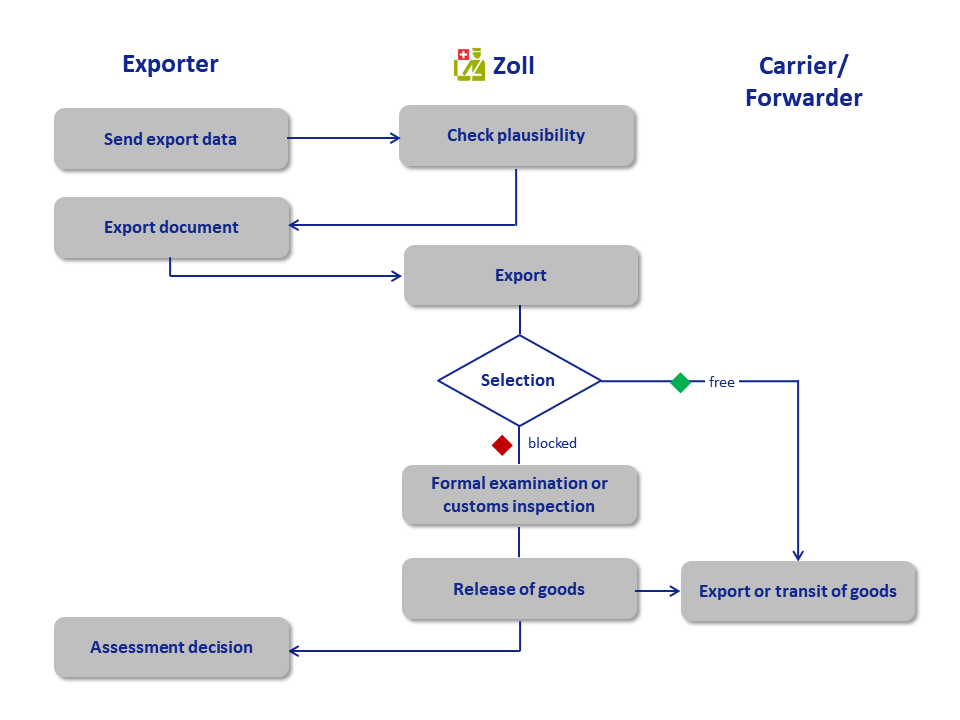

In the second phase, the carrier registers the export list from the consignor in the e-dec system as Selection&Transit. After the electronic transmission, the data is checked by customs. If the selection result is FREE, the customs office prints a delivery note or generates another document. The goods can then be sent directly to export control and exported.

If the selection result is BLOCKED, any additional documents must be presented to the customs authorities. The documents will then be formally checked and, depending on the result, the goods will be inspected.

Once the inspection has been completed, the consignment is released in the system by customs and the goods can be presented to the export inspection and exported or passed on to the NCTS (transit).

If the consignor is an Authorised Consignor, the export declaration may be made at his domicile, with indication of the control customs office. In this case, the selection is already made upon acceptance of the customs declaration and printed on the export list.

If the selection result is FREE, the goods are in free circulation and can be exported.

If the selection result is BLOCKED, the intervention period begins. If customs do not request a physical inspection during this period, only the documents must be submitted to customs, and the goods can be disposed of immediately.

Process e-dec Export

Special procedures in export

EU customs clearance

With EU customs clearance, goods exported to an EU country are not cleared through customs in the country of destination but already after crossing the border into the EU.

Goods destined for the Netherlands are thus cleared through customs immediately after crossing the German border. The goods are consequently in free circulation within the EU and can be transported within the EU customs union without further customs procedures.

However, this procedure can only be used under certain conditions:

- The Swiss supplier must be registered for VAT in the EU and must have a tax number and a VAT identification number. However, they do not need to have a registered office in an EU country.

- The goods may not remain in the country in which EU customs clearance was carried out.

- The supplier invoice must show both the VAT identification number of the sender and the recipient, and both must come from two different EU member countries. The delivery conditions (Incoterms) must also be indicated.

- Reference to the tax exemption (§6a UStG)

Since only few suppliers are registered for VAT purposes in the EU, a fiscal representative can be called in. Most freight forwarders or specialised customs agencies offer this service.

Fiscal representatives provide the supplier with special VAT identification numbers and handle the necessary declaration obligations.

The supplier only has to ensure that all the necessary information is shown on the commercial invoice.

- Reference to the fiscal representation including address and VAT identification number

- VAT Identification number of the invoice recipient

- Incoterms

- Reference to the tax exemption

Proofs of origin

Other than in import, exporters may issue proofs of origin themselves when exporting. At least one of the following conditions must be fulfilled.

- The goods are entirely produced in Switzerland

- The goods have been sufficiently treated in Switzerland

- The goods were imported with a certificate of origin and are re-exported unchanged.

In addition to the export department, which is responsible for issuing the documents, purchasing and production planning must also be involved in determining and managing the origin of goods.

The origin of a product corresponds more or less to the citizenship of persons. A preference document is therefore comparable to a passport and thus confirms the origin of a product.

It is important to consider that a product originating in a given country does not automatically originate in the same country. For example:

Country of dispatch: Japan

Country of origin: China

Goods keep their origin as long as they are not modified.

False issue of a proof of origin may have inconsiderable consequences. On the one hand, the consignee who wrongly imported the goods at a reduced rate of duty will be subsequently charged. On the other hand, the issuer of the proof of origin will be fined and may face recourse claims by the foreign consignee of the goods.

Invoice declaration

Exporters that frequently export goods can apply for ‘approved exporter’ status. They can thus issue the declaration of origin on the invoice without any value limit and are also exempt from the requirement of a handwritten signature. This means that there is no need to complete and apply for a movement certificate.

The wording of the invoice declaration is specified in the free trade agreements and varies according to the agreement and language.

![]()